Bitcoin Taproot – what you need to know about the biggest BTC network update

A lot has already been written about the limitations of Bitcoin and its scripting capabilities, especially when compared to the Ethereum network. Both Bitcoin and Ethereum rely on cryptography and distributed ledger technology, but so far Bitcoin’s utility has been mostly limited to its role as a store of value and decentralized payment network. This may soon change with an upcoming update to BTC’s network, Taproot.

Over the past few years, a number of projects have emerged in the cryptocurrency market, providing greater privacy, lower transaction fees and faster transfers than Bitcoin. Scheduled for November, the Taproot update is expected to make the most popular cryptocurrency catch up with the rest of the stakes and maintain its reign on the market.

Reduce transaction size while increasing efficiency

Taproot is the first such major update to the Bitcoin network since 2017, and one of the most eagerly awaited technological improvements by the cryptocurrency community. And that’s no surprise, since Taproot is intended to improve the privacy and security of transactions, as well as provide faster and cheaper. The word “taproot” means, in English, a kind of long root that consists of a main part that grows vertically downward and side roots that are shorter and thinner, growing diagonally or horizontally, with further branches growing in different directions. Examples of plants with such roots (called stakes) are carrots and dandelions.

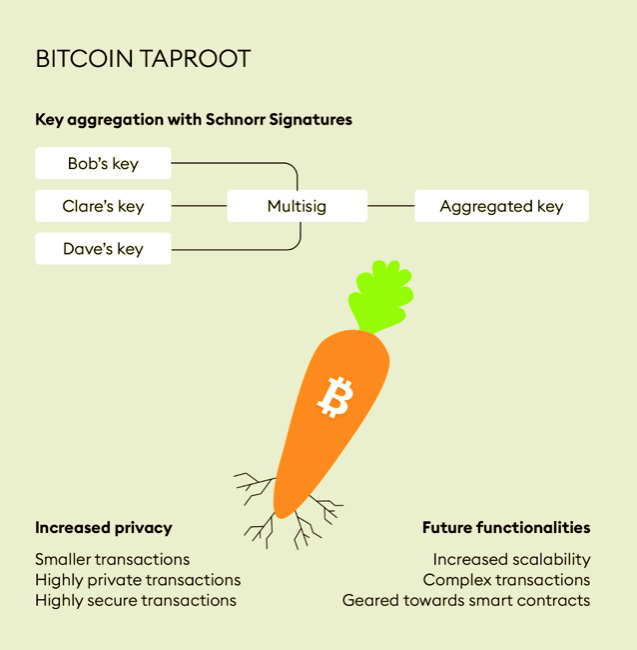

To be able to fully explain how the update works and where its name comes from, it is first necessary to explain how transactions on the blockchain network take place from a technological point of view. Bitcoin comes with a scripting system with the ability to specify all possible conditions by which a transaction can be made. Currently, all conditions are stored, disclosed and validated on the blockchain. With the introduction of Taproot, all these conditions will be collected in a single shortcut tree (“Merkle tree”) based on the MAST principle – thus, only one condition needs to be exposed. A hash tree combines multiple hashes at the “root,” thus reducing the size of a transaction while increasing the privacy of its participants.

Key aggregation with Schnorr signatures

One of the components of the Taproot update is the Schnorr signature protocol, which allows for signature aggregation for multiple parties who want to submit one common, unique signature. In practice, this translates into much greater privacy and security of transactions, as well as a significant relief to the BTC network. The generated common signature will take up the same amount of space as any single user signature does now, which leads to quite a bit of network memory savings. Additionally, linked signatures make it difficult for outside observers to tell who signed (and who didn’t) a transaction. Consequently, someone who is not involved in the transaction will not be able to see that it hides a complex smart contract. In addition, signatures on the Bitcoin network will no longer be “malleable” – they will not be able to be changed before a particular transaction is confirmed.

First step towards smart contracts

The Taproot update has the potential to become a sort of “leaven” for further technological development of the Bitcoin network. It is also a step forward in the pursuit of newer and more functional cryptocurrencies. Running smart contracts on Bitcoin’s underlying protocol layer will continue to be expensive and time-consuming. However, with the implementation of Schnorr signatures, it will be possible to further scale the Bitcoin network. Taproot will make it possible to associate a key with a hash of data, such as. timestamps for regular transactions with a high level of privacy, while also improving the technology behind Bitcoin to lay the groundwork for future smart contract features. Further technological development, improved privacy, performance and security of the Bitcoin network should also contribute to the attractiveness of the largest cryptocurrency in the eyes of investors.

Author

Krzysztof Raś, Vice President of Marketing. Software engineer and managing director of Bitpanda in Poland