1,5-2.EUR 1.5-2 billion – it is estimated that this is the value of the FinTech market in Central and Eastern Europe

Companies from Poland account for almost half of this value. There are already several hundred of them, although only a dozen have managed to build scale. What is the current situation of the sector in the country and can Poland become a “FinTech Hub”??

As in other markets, FinTechs that have focused on the payments market have been the most successful so far – in particular, PayU (which got its start as a platform that handles payments on Allegro) and BlueMedia, which offers a range of payment solutions, including instant payments that compete with the state-owned Express Elixir, allowing funds to be transferred from account to account in minutes.

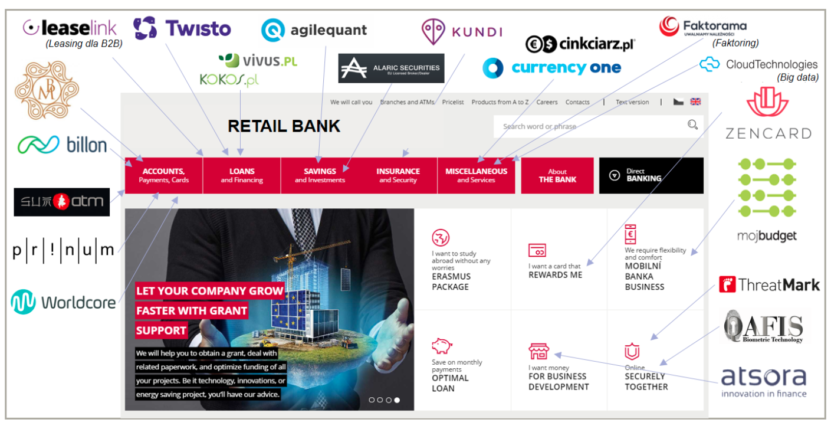

However, if one were to look at the FinTech market in Poland from the perspective of a bank directing its offer to retail customers, it quickly becomes apparent that alternative players are already addressing almost all areas of its business, while focusing on a single product and a narrow offer, they are often better able to reach the customer and adapt to their needs. Following this pattern and focusing on FinTechs that have already built at least a minimum scale, the following examples can be identified:

Moresise or Pri-num offering solutions in the form of mobile wallet, to which we can easily connect the source of financing (account, card) and make convenient payments;

– Billon offering payments using blockchain technology;

– Currency One and Cinkciarz focused on financially attractive foreign exchange offers;

– Kokos and Vivus providing loans (the former with a crowd- / social-lending model, the latter with a more traditional approach and focus on micro-loans);

– Moj budget helping to plan expenses and manage a household budget, or Atsora offering a financial analytics platform for SMEs;

– Zencard (recently acquired by PKO BP) – a single platform for managing multiple customer loyalty programs;

– Leaselink offering B2B leasing.

Most of these companies define Europe or the world as their target market. Many of them are already operating in multiple markets today (e.g. Billon, Zencard or Finanteq offering mobile solutions for banks).

Does coming from Poland support them?

Currently, to a small extent, which makes some even position themselves as foreign companies. The best example is Billon, which presents itself as a company as British as it is Polish. This is due to both the perception of the UK market as a “FinTech Hub” and the overall support enjoyed by start-ups in the UK compared to Poland.

Many regulations, including in particular PSD2, which will allow FinTech easier access to data on customer accounts held at banks, have a positive impact on the development of the sector. In Poland, an additional benefit is the high level of digitalization of financial services in general, which creates room for more interesting innovations.

Can Poland become a “FinTech Hub”?

It is possible, but it would be necessary to create a coherent vision for the development of the sector in Poland with a clear role for investors, financial institutions and the government, as well as an attractive system of incentives to open their business here. All initiatives that make it easier to start and run a business in general will also be helpful, as well as tax solutions attractive for investors directing their funds to innovation development.

In the current political climate, the focus of attention of those in power is elsewhere and we risk missing an opportunity to create a “FinTech Hub” for Central Europe in Poland.